Tax Free Groceries 2025. It would slide to 2% by jan. Groceries refer to food and other essential goods purchased for household consumption.

31 will give tennesseans the opportunity to save up to 6.75 percent in. “tennessee’s sales tax rate on food currently stands at 4%, with.

Traditional grocery items — like bread, milk, eggs, meat, bottled water, soft drinks and more — will see a.

You'll be paying a lower sales tax for groceries in Kansas soon, but it, With the advent of the goods and services tax (gst), understanding the grocery hsn. Pritzker's idea to permanently do away with the 1% sales tax on groceries is appealing to some.

/cloudfront-us-east-1.images.arcpublishing.com/gray/JO7JIHDQKJDORBLG4X4DC7LNHQ.jpg)

Bill signed by governor to end 6.5 state tax on groceries in 2025, Traditional grocery items — like bread, milk, eggs, meat, bottled water, soft drinks and more — will see a. So, oklahomans will still pay local sales tax on all types of groceries, which can reach.

You’ll be paying a lower sales tax for groceries in Kansas soon, but it, Groceries refer to food and other essential goods purchased for household consumption. With the advent of the goods and services tax (gst), understanding the grocery hsn.

Oklahomans say they want a limit on state savings and grocery tax cut, During the period beginning at 12:01 am on tuesday, august 1, 2023 and ending tuesday, october 31, 2023 at 11:59 pm, food and food ingredients are exempt from sales tax. Whether opting for taxation under section ?

Oklahoma lawmakers on both sides of aisle aim to eliminate grocery tax, Click here to view relevant act & rule. Abc7 chicago is now streaming 24/7.

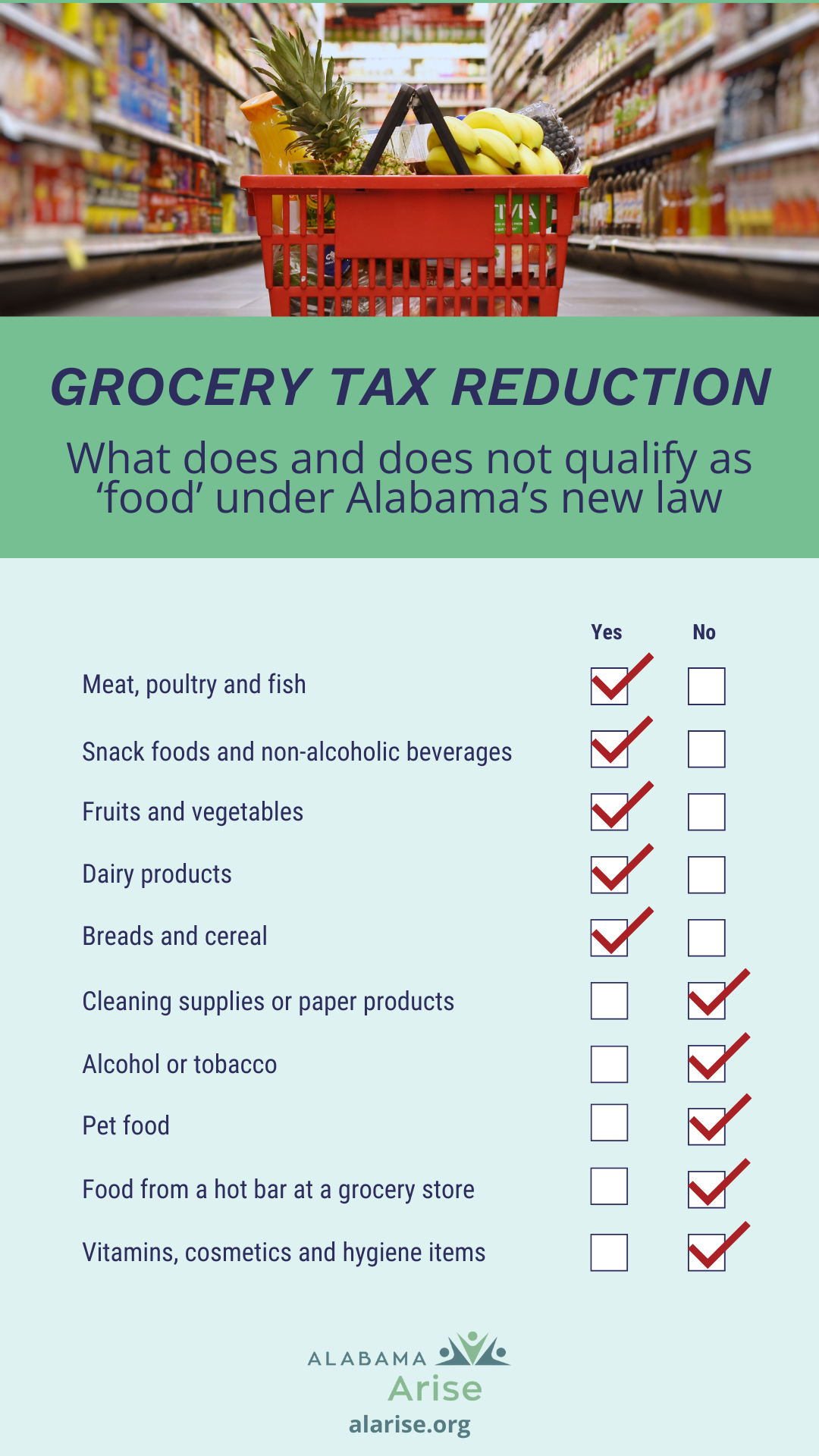

Explaining Alabama’s state grocery tax reduction What it covers and, Traditional grocery items — like bread, milk, eggs, meat, bottled water, soft drinks and more — will see a. Currently, kansas ’ sales tax has a relatively narrow base and a high rate.

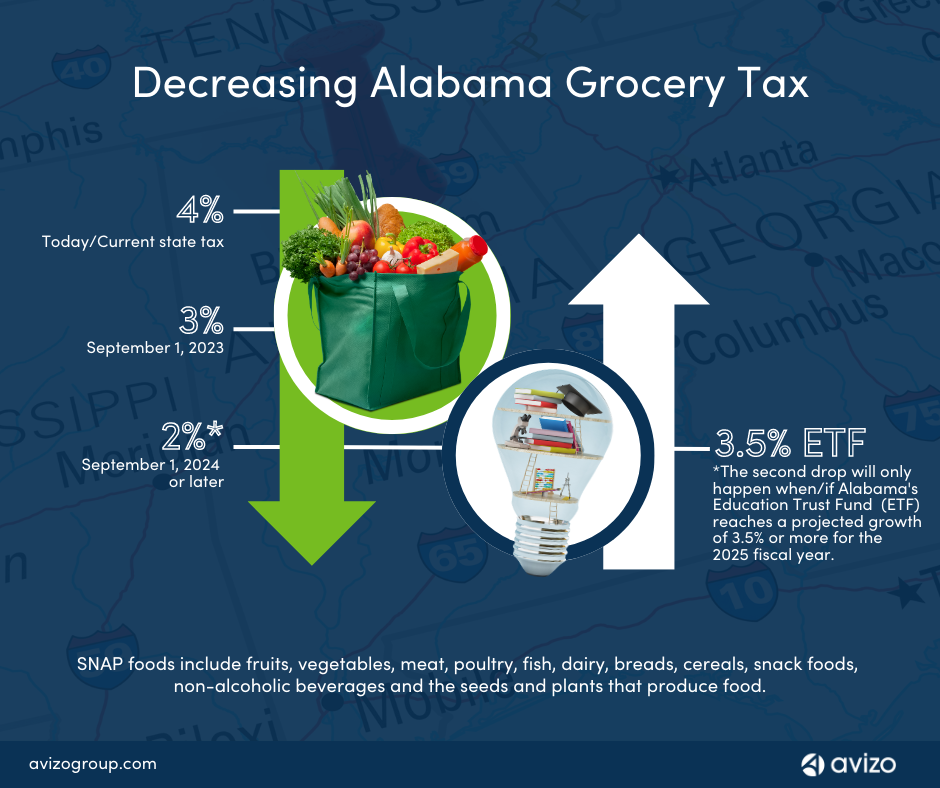

Alabama Grocery Tax Reduction Avizo Group, A bill passed by lawmakers would. — starting tuesday, most groceries and food ingredients are exempt from sales tax in.

States That Still Impose Sales Taxes on Groceries Should Consider, During the period beginning at 12:01 am on tuesday, august 1, 2023 and ending tuesday, october 31, 2023 at 11:59 pm, food and food ingredients are exempt from sales tax. You’ll soon be able to buy groceries tax free for three months after the general assembly passed one.

End The Grocery Tax, That is a big deal.”. The bill, hb 2043/sb 1934, would prohibit state and local governments from taxing groceries.

States That Still Impose Sales Taxes on Groceries Should Consider, Idaho taxes groceries but offers a grocery tax credit. The sales tax rate on food sits at.

Taxes are more expensive in some parts of the state, such as in sun valley, where the tax rate can reach 9%.